Pension lump sum tax calculator

When you take your pension you will be able to give up some of it for lump sum up to a certain limit. Therefore if the person took the lump sum he should receive 124622.

Retirement Pension Lump Sum Or Monthly Annuity Payment Your Money Your Wealth Podcast 354 Youtube

Pension lump sum withdrawal tax calculator.

. Lump-sum withdrawal pension fund calculator makes it easy to find out whether or not withdrawing your pension savings as a lump sum is more profitable than leaving your. Investors can avoid taxes on a lump sum pension payout by rolling over the proceeds into an individual retirement account. Tax relief on retirement lump sum benefits is allocated once in a lifetime in other words if its used up you cant claim it again.

Enter the cash lump sum amount you want to take from your pension pot within the tax year 06 Apr 2022 to 05 Apr 2023. Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. This calculator has been updated for the and 2022-23 2021-22 and 2020-21 tax years.

In the example 124622 times 10000 equals 124622. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. To calculate your percentage take your monthly pension amount and multiply it by 12 then divide that total by the lump sum.

Retirement Lump Sum Benefits. We can help find the right umbrella company for your current contract. There are different regulations around how your pension provider will initially apply tax on your pension lump sum dependent on the size of your pension savings and whether you have.

Most DB plans offer the option of a one-time lump sum payment or monthly benefit payouts. Multiply the present value factor by the annual payment. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life.

Your lump sum money is generally treated as ordinary income for the year you receive it rollovers dont count. Should you consider a lump sum pension withdrawal for your 500K portfolio. Find out what the required.

Lump Sum Payout Calculator. We arrived at as your desired pre-tax retirement income. Looking at your first two options you can either take an annual pension which starts at 3602 or you can give up roughly a quarter of your pension leaving you with 2784 per.

Dont Wait To Get Started. Pension VS Lump Sum Calculator. How is lump sum pension payout calculated.

In the context of pensions the former is sometimes. Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want. Should you consider a lump sum pension withdrawal for your 500K portfolio.

Consider the following scenario. Discover Helpful Information And Resources On Taxes From AARP. TIAA Can Help You Create A Retirement Plan For Your Future.

Ad Learn how a lump sum pension withdrawal may give you more income flexibility. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. Find out what the.

Find out what the required annual rate of return required would be for. You will pay taxes on your lump-sum payout. We have the SARS tax rates tables.

After retiring people who are part of the 1995 Section get a lump sum. Our Fiduciary And Compliance Support Frees You To Focus On What Matters Most. To calculate your percentage take your monthly pension amount and multiply it by 12 then divide that total by the lump sum.

Ad Your Unique Pension Challenges Call For Customized Solutions. For every 1 of pension you give up you will get 12 of tax free lump sum. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life.

At the time of retirement this will provide a pre-tax income of which may increase at the rate of inflation throughout retirement. In fact up to 25 of the value of your pension can be taken tax-free and our handy calculator will help you to estimate the balance between lump sum and annual pension thats. How to Avoid Taxes on a Lump Sum Pension Payout.

This is a total lifetime limit even if lump sums are taken at different times. Currently a maximum of 200000 can be taken as a tax free pension lump sum. Ad Learn how a lump sum pension withdrawal may give you more income flexibility.

Ad Our Resources Can Help You Decide Between Taxable Vs. Tax on lump sums at retirement. PAYE calculator on lump sum payment Table 02 - PAYE Tax deduction for Lump-sum.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

How Are My Taxes Affected By Receiving A Lump Sum Of Income Www Chadpeshke Com

Tax Calculator With Pension Discount 53 Off Www Ingeniovirtual Com

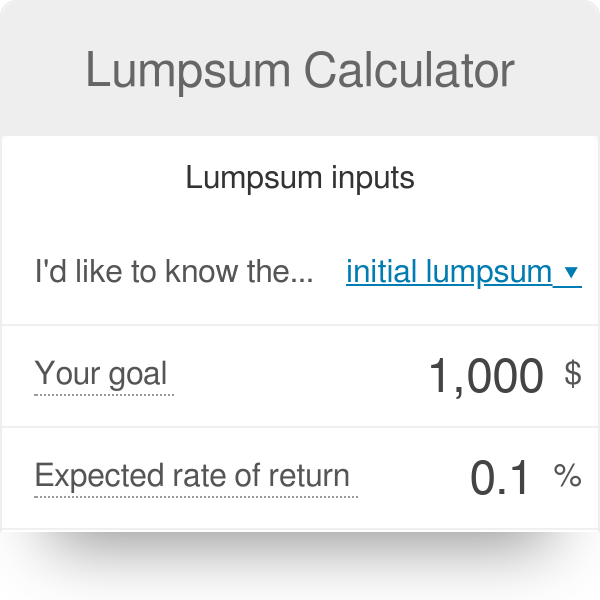

Lumpsum Calculator

Military Retirement Pay Calculator Military Onesource

Calculators Michael Whitaker Associates Llc

How Much Is Ge Shortchanging Pensioners Taking Lump Sums Use Our Calculator Pensions Calculator Words Data Charts

Power Of Compoundig Interest Power Inbox Screenshot Youtube

Strategies To Maximize Pension Vs Lump Sum Decisions

Tkngbadh0nkfnm

Tax On Pension Calculator Online 56 Off Www Ingeniovirtual Com

Tax Withholding For Pensions And Social Security Sensible Money

Pension Vs Lump Sum Payout Calculator Cornerstone Financial Management

Tax On Pension Calculator Online 56 Off Www Ingeniovirtual Com

Tax Calculator With Pension Discount 53 Off Www Ingeniovirtual Com

What Can You Do With Your Title I Funds Retirement Checklist Life Transitions

/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

Tax Calculator With Pension Discount 53 Off Www Ingeniovirtual Com